Fostundex App Login

Submit Your Fostundex App Access Credentials

Discover Fostundex App for the first time? Join Us Today!

REGISTER TODAY AT NO COST

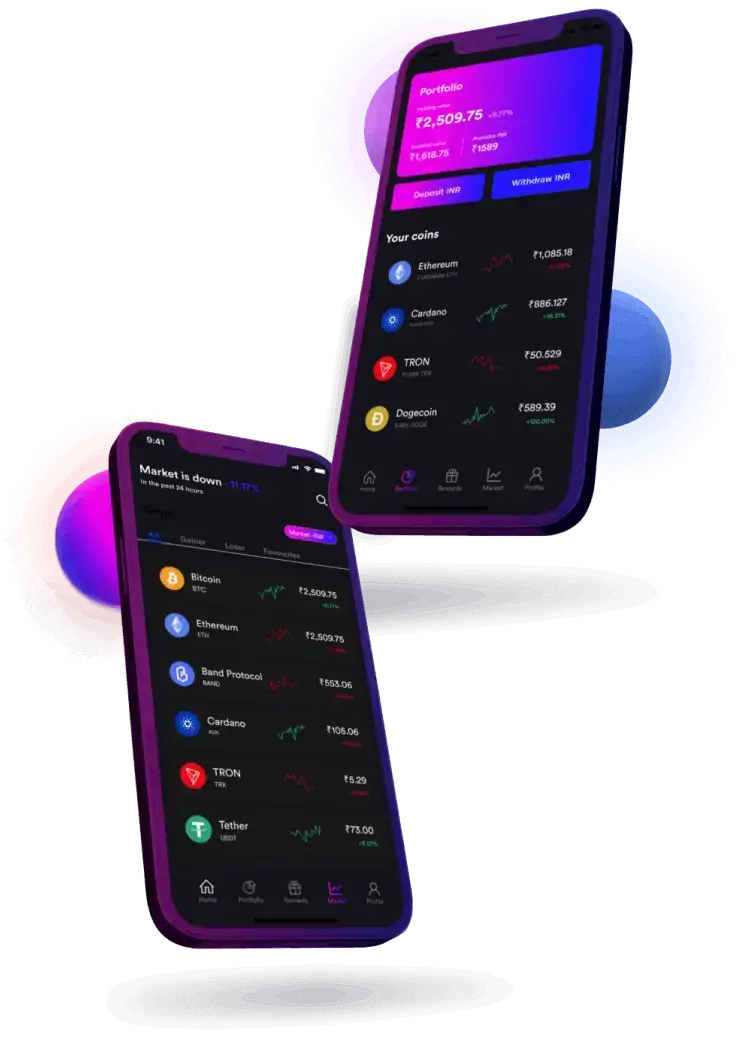

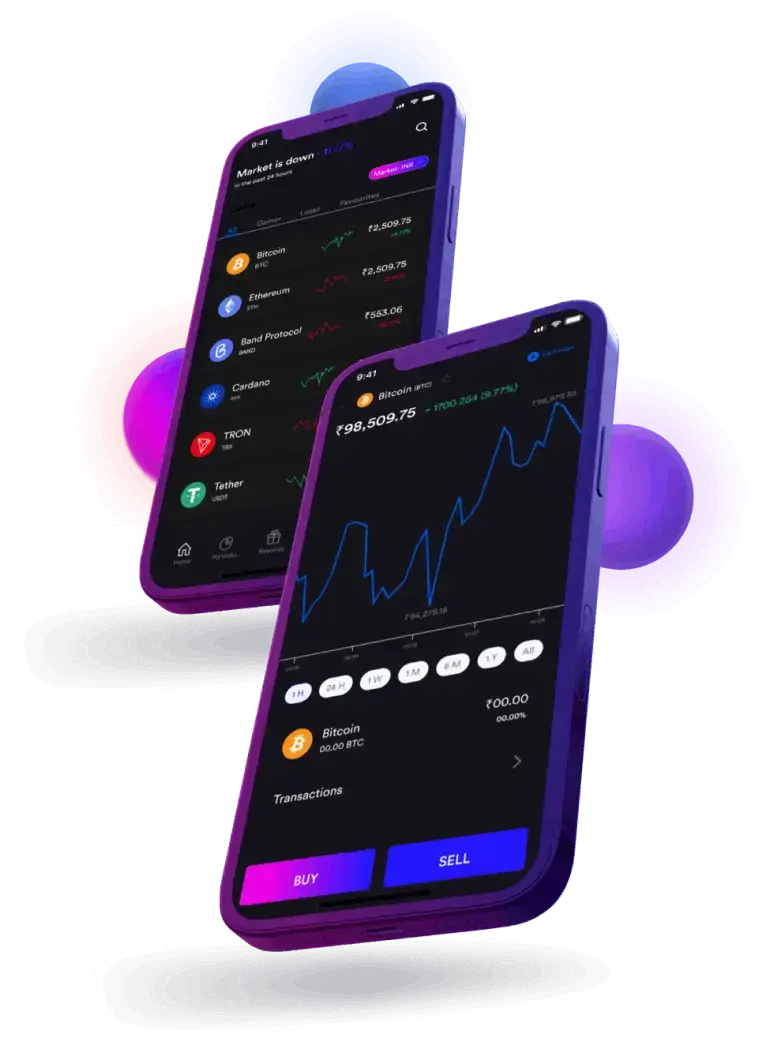

Explore the Realm of Fostundex App

Choose either "Enroll" or "Join now."

Complete the enrollment form by providing vital information, including your full name, email, and phone number.

Account Password

Formulate a robust and safe password for your profile. Hit the "join now" or "enroll" option to finalize the registration procedure.

IS IT WISE TO POSTPONE INVESTING UNTIL THE CRYPTO MARKET RECOVERS?

No

Seize the opportunity to engage in trading. Current developments in the cryptocurrency landscape indicate a favorable relationship with broader economic signals. Notably, the crypto sector often outpaces others in recovery following declines, sparking significant price movements. This swiftly evolving market is captivating an ever-expanding crowd of investors. Anticipations are strong for a prolonged price trajectory coupled with rising trading activity.

Capital markets serve as venues for the issuance and trading of financial instruments like stocks and bonds. These markets provide a vital mechanism for corporations and governments to secure funding for a variety of initiatives, while also offering investors avenues to generate returns on their investments. They are essential to economic growth by channeling funds from savers to entities in need of capital for expansion. By operating through both primary markets, which involve the creation and sale of new securities, and secondary markets, where already issued securities are exchanged, capital markets uphold both liquidity and market efficiency. Ultimately, they function as a conduit that connects those who seek investments with potential investors, thus driving comprehensive economic development.

Capital markets play a crucial role in the financial landscape by facilitating the trading of long-term debt instruments and equity securities. These markets provide avenues for investors looking for lucrative opportunities and for businesses that need investment capital, operating via stock exchanges and bond markets. Maintaining the stability of capital markets is vital to avert market volatility, economic downturns, and increased unemployment. They direct surplus capital from investors to companies, governmental agencies, and organizations seeking funding for large-scale projects and expansion strategies.

TAPPING INTO THE POWER OF DIGITAL CURRENCY

Decentralization

Cryptocurrency offers investors increased autonomy and security due to its decentralized framework. This creates a significant investment opportunity, unbound from regulation by government entities and financial institutions.

High volatility

The dynamic world of digital currency presents a blend of opportunities and obstacles, highlighting the potential for significant gains or losses in a matter of moments.

Increased adoption

The surge in cryptocurrency usage is characterized by the increasing acknowledgment and deployment of digital currencies. Cryptocurrencies are being more frequently utilized for transactions, recognized as valuable assets, and leveraged for fundraising initiatives through Initial Coin Offerings (ICOs).

This rising trend is driven by an enhanced understanding of the advantages linked to cryptocurrency. These advantages include its decentralized structure, robust security features, and the potential for exceptional returns. In addition, the user-friendly access to cryptocurrency provided by streamlined wallets and trading platforms has significantly contributed to its expanding allure.

Moreover, corporations and merchants are integrating cryptocurrency as a viable payment option, which is boosting its acceptance and market value. Well-known firms such as Microsoft, Tesla, and AT&T have embraced Bitcoin as a valid payment alternative.